vanguard high yield tax exempt fund review

Fidelity Short-Term Treasury Bond Index Fund Accessed April 30 2021. An alternative investment also called an alternative asset is an investment in any asset class excluding stocks bonds and cash.

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

The Vanguard Wellesley Income Fund VWINX is a hold-over of the Vanguard acquisition of the Wellington Management Company.

. CA LT Tax-Exempt Investor. As of 10312021. Tax-Exempt Vanguard Bond Funds.

012 Long-Term State Muni List. As of 01312021. ETFs may hold positions in many different assets including stocks bonds and.

A high correlation between funds may mean that your portfolio of funds is not as diverse as you might want it to be. Dear POF Thank you for the step by step instructions. Pay Off Debt.

Vanguard High-Yield Tax-Exempt Fund VWAHX is a mutual fund that can provide income while generating low or no taxes. Name Ticker AER 1. Buy this fund Buy online now.

To invest in VTSAX via Vanguard you must invest a minimum of 3000 and additional investments can be made in 1 increments. As of May 2021 expenses for VWAHX are 023. And 2 Vanguards Tax-Managed Balanced Admiral Fund VTMFX that requires 10000 to purchase.

But if you also plan to do anything else including investing in individual stocks youll probably need to consider a second brokerage firm. Its dividend yield based on the trailing 12 months as of January 2021 is 141 with 966 of those being qualified dividends making it a very tax-efficient fund to own in a taxable brokerage account. March 19 2020 at 645 am.

As of 01312021. 017 Investor 009 Admiral. Vanguard Total International Bond Index Fund Admiral Shares VTABX Accessed April 30 2021.

This is a very diversified mutual fund that is suitable for retirement planning. As Ive discussed in this Vanguard review if youre looking for something specific such as a target date fund Clarks recommended blend of index funds or a savings account alternative its great. As of 07312021.

Tax-Exempt Bond Index Admiral Shares Purchase Fee. As of 07312021. Buyers of tax-exempt funds like VWEHX are often high-income individuals with taxable accounts.

As of 06302021. Tax-exempt municipal bonds used to reduce taxes for taxable accounts. Importantly more than 80 of the.

As of 10312021. For some investors a portion of the funds income may be subject to state and local taxes as well as to the federal Alternative Minimum Tax. As the name suggests its designed to match the performance of a broad swathe of equities specifically the CRSP US.

Vanguard Short-Term Bond Index Fund Admiral Shares VBIRX Accessed April 30 2021. Vanguard Tax-Exempt Index Fund. 3000 50000 for Admiral This last one represents a very specific type of investment that fulfills a small need if you want a low cost.

High-Yield Corp Fund Inv. As of 04302021. Vanguard Tax-Exempt Bond ETF VTEB Next up the Vanguard Tax-Exempt Bond ETF was developed to track an underlying benchmark that tracks investment-grade municipal bonds in the United States.

This mutual fund seeks to provide long-term growth of income and a high. Due to the assets held in the fund it is known for producing high levels of income compared to other bond funds. High-yield municipal bond ETFs offer tax-exempt yields to investors in diversified portfolios that mitigate some of the debt instruments.

It has a one-year yield of 218 and a 10-year yield of 901. I bought VCLAX CA exempt long term and VMLTX national limited term tax exempt a week ago and since have tanked relatively speaking If yes I am not sure what to exchange it for I may just exchange for VOO and just wait a month and then re-purchase these bonds. While other tools may compare funds only to the SP 500 or 500 Index fund you can use this tool to determine how closely the performance of one Vanguard stock fund tracks that of any other Vanguard stock fund.

While other tools may compare funds only to the SP 500 or 500 Index fund you can use this tool to determine how closely the performance of one Vanguard stock fund tracks that of any other Vanguard stock fund. The term is a relatively loose one and includes tangible assets such as precious metals collectibles art wine antiques coins or stamps and some financial assets such as real estate commodities private equity distressed securities hedge funds. High Yield Muni.

Get details on fees minimums for Vanguard mutual funds. Experts recommend keeping a decent amount of your emergency fund in a high-yield savings account like the one offered by Wealthfront Cash. Vanguard High-Yield Tax-Exempt Fund Admiral Shares VWAHX Quick Fund Stats.

Minimum tax cost basis method minimizes tax impact by identifying select units or quantities lots of securities to sell. Vanguard Long-Term National Muni List. Although the income from a municipal bond fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own redemption of shares.

Read and consider it carefully before investing. Name Ticker AER 1 Yr. 1 Vanguard High Yield Tax-Exempt Admiral Fund VWALX that requires a minimum of 50000.

If you have debt that you are paying off gradually use some or all of the 50000 to pay down that debt especially if the debt carries a relatively high interest rate. Because it holds municipal bond funds the income is not taxable at the federal level. The Vanguard Total Stock Market ETF VTI is also available as a mutual fund but the ETF version is a better fit for investors who cant meet the 3000 mutual fund minimum.

An exchange-traded fund is an investment fund that trades on a stock exchange. Compare all the funds that you own. A high correlation between funds may mean that your portfolio of funds is not as diverse as you might want it to be.

Most Vanguard mutual funds require a minimum investment of 3000 But you can invest in any Vanguard Target Retirement Fund or in Vanguard STAR Fund with as little as 1000. SIMPLE IRAs Individual 401ks and Vanguard 529 Plan accounts have special account service fees. For example if you have 30000 in credit card.

Find the latest Nuveen Municipal High Income Opportunity Fund NMZ stock quote history news and other vital information to help you with your stock trading and investing. Total Market Index which includes a mix of small- mid- and large. Investment objectives risks charges expenses and other important information are contained in the prospectus.

50 of the fund consists of mid-cap and large-cap stocks. It has a one-year yield of 105 and a 10-year yield of 56. Compare all the.

As of 12312020. Prospectus Download it now.

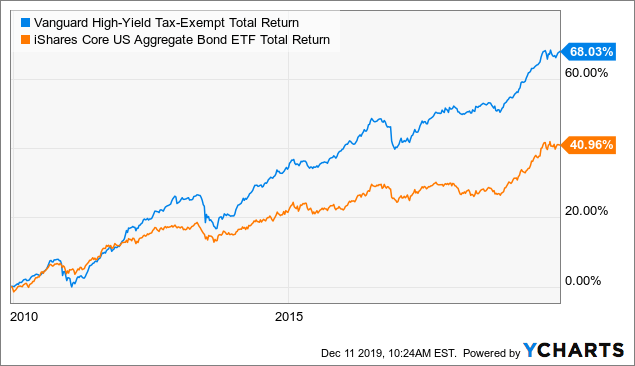

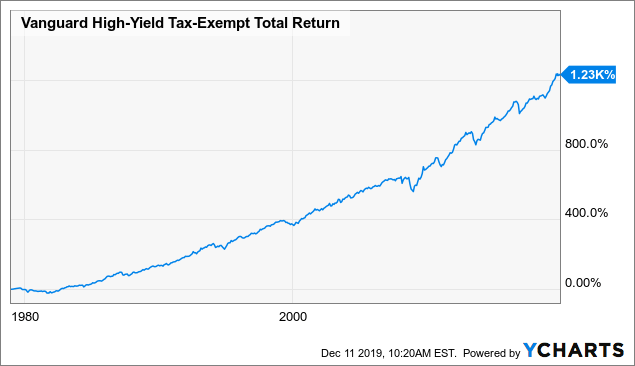

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha

Vanguard High Yield Tax Exempt Fund Vwahx Latest Prices Charts News Nasdaq

Vwalx Vanguard High Yield Tax Exempt Fund Admiral Shares Class Info Zacks Com

Vanguard High Yield Tax Exempt Don T Call It Junk Kiplinger

Vanguard High Yield Tax Exempt Don T Call It Junk Kiplinger

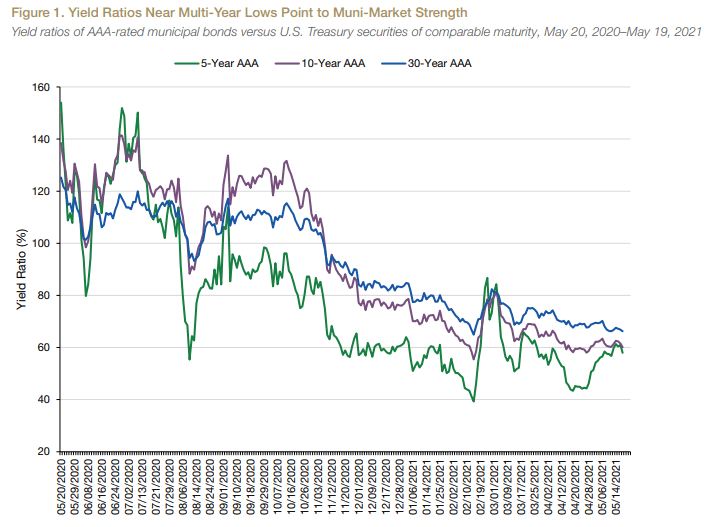

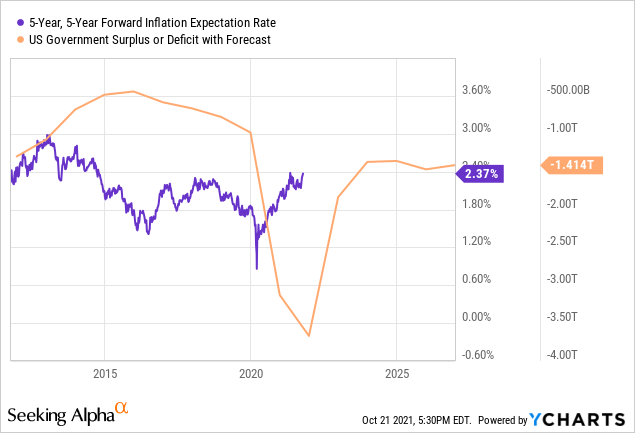

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha